In Newtonian mechanics, momentum is the product of mass and velocity. Objects with momentum

possess magnitude and direction.

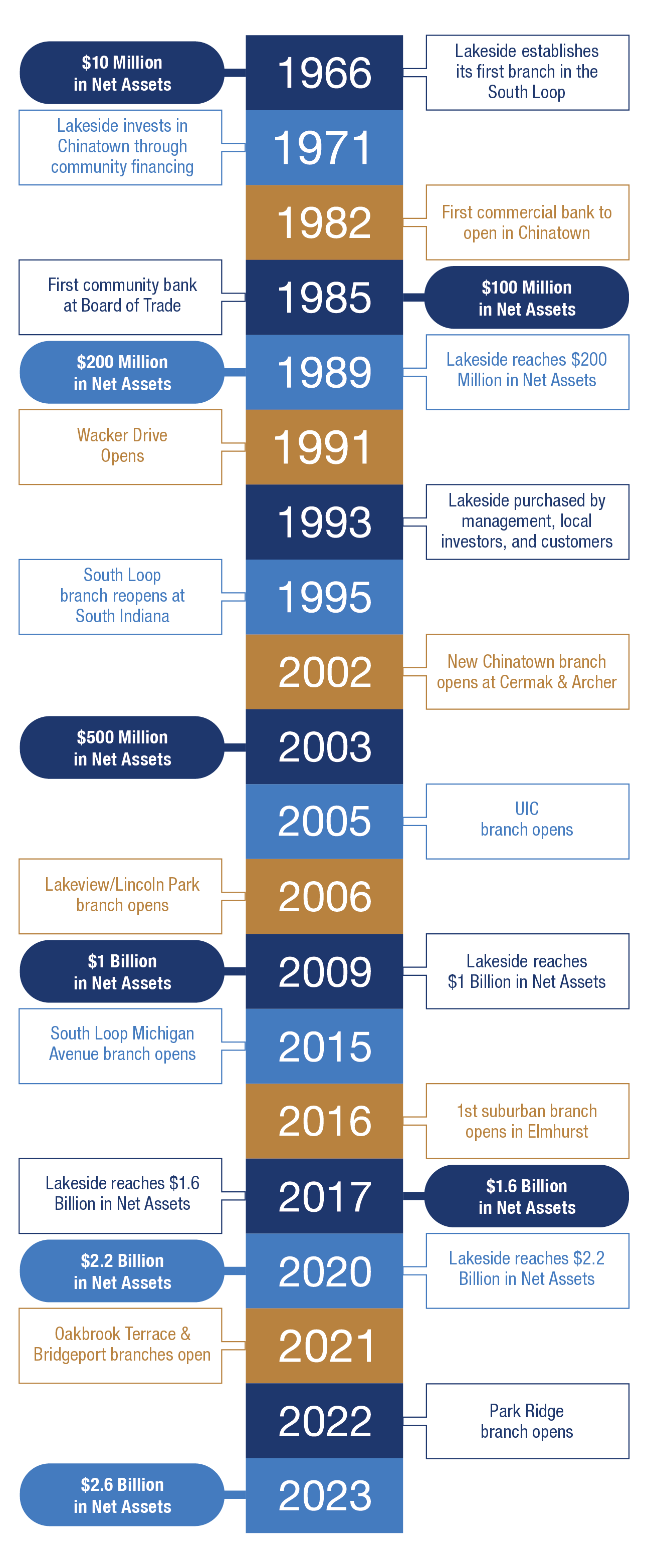

Lakeside Bank: A Service Focused Business … with Momentum

Lakeside Bank Has Momentum … literally mass, velocity, magnitude, and direction … thanks to our clients. The clients we’ve had for decades and generations. And the clients who continue to join us as they see the difference Lakeside can make for their personal and business banking.

2024 was a year of both stabilization … and change. New political leaders and policies require adaptation. And Lakeside has adapted to every change, always building momentum. We adapted to the recession of 2001, the financial crisis of 2008, the pandemic in 2020 and the bank failures that stressed the system in 2023. We’ve always emerged stronger. What we do, and how we do it, is unique and our brand is strong. That’s Lakeside Momentum.

We do right for our clients, and so we do right for the Bank. The result: Lakeside Momentum.

- 1993-2002, our net assets grew from $194 million to $446 million. Aggregate earnings were $60.37 million.

- 2003-2012, Lakeside surged from $522 million to $1.1 billion, with net aggregate earnings of $132.71 million.

- 2013-2022, we doubled … $1.1 billion to $2.3 billion in assets & net aggregate earnings of $329.05 million.

Lakeside has consistently outperformed our peers across a thirty-year period.

As we closed 2024, our 58th year, we’re at $2.7 billion in net assets. Lakeside is in the top 9.5% of banks in America, the 385th largest of 4,049 banks. Multiple new branches were in development in 2024. Our Mount Prospect branch launched February 2025. Naperville will open summer 2025. And there are already two more branches in early planning. We’re bringing our unique service to more and more Chicagoland communities.

The Macro Environment: 2024 and into 2025

The economy remained healthy through 2024. Unemployment was low; 4.1% in December. Real GDP was up 2.8% for the year, down slightly from 2.9% in 2023. While inflation was above the Fed’s 2% target, the 2.9% annual average was a welcome relief from the 4.1% of 2023 and the 8.0% of 2022. The prime rate hit a high of 8.5% late 2023 and now, with a full point cut, sits at 7.5%. Conversely, the 5- and 10-year US Treasuries are at 4.37% and 4.57% respectively. Tariffs have taken center stage, adding uncertainty to growth, inflation and the flow of goods & services. Consumer spending has started to slow.

The national deficit, now more than $35 trillion, is of course a concern. Our national spending at $7 trillion is unsustainable with tax receipts at $5 trillion. In addition, the quantitative tightening that began in May of 2022 has drained trillions from the system. These unprecedented forces cause us to remain cautious.

We expect extension of the 2017 tax cuts and an increase in federal spending, particularly on defense, and a modest offsetting gain in tariff revenue. This would leave the primary deficit as a percentage of GDP steady. The debt-to-GDP ratio is approaching an all-time high, though, and real interest rates across the treasury curve are higher than the last cycle.

Lakeside Financials: Key 2024 Indicators

Lakeside’s balance sheet is strong, flexible and compares favorably to the marketplace. Our earning assets are short in duration, leverage capital is well in excess of “well capitalized” at 11.0%, and our asset generation machine has allowed us an offset to rising interest expense. Balance sheet growth is moderate and measured, with continued positive asset quality, and a well-funded ALLL reserve at 1.26% protects against future potential loan losses and risk exposure. 2024 retail deposits were up 11.8% versus the previous year and our loan portfolio increased 3.5%.

Additional priority information:

- At year-end 2024, total assets were $2.7 billion. Total loans stood at $2.07 billion (90% of our earning assets) and securities at $228 million (10% of earning assets), manifesting total earning assets of $2.3 billion.

- Net income was $33.1 million, down from last year. Unique income events in 2023, primarily the $6 million from the sale of our Roosevelt branch, are the bulk of the difference. Organic growth expenses for our new branches also impacted 2024 income. Buying land, building, outfitting, and staffing the Mount Prospect and Naperville branches added significant costs last year but sets the stage for future growth.

- Return on Equity and Return on Assets were more than 12.64% and 1.24% respectively, both well above our national peer group average.

- Our positive asset quality and well-funded ACL reserve (Allowance for Credit Losses) at 1.26% provides for future risk exposure.

- While many FI’s face commercial real estate loan issues, Lakeside is healthy and actively making loans.

- As of December 31, 2024, our newest branches continue to exceed expectations: Oakbrook Terrace at $99 million, Bridgeport at $102 million and Park Ridge at $80 million. Mount Prospect opened its doors early February 2025 and was already over $32 million in total deposits as of mid-April.

Treasury Management

The department had another outstanding year. We expanded our team to support growth already achieved, and to be prepared for opportunities in 2025 and beyond. We added a Senior Vice President of Treasury Management Sales to drive sales initiatives and enhance client service and a TM Implementation Support Specialist to streamline onboarding and strengthen ongoing service and speed. As the Lakeside branch network grows, Treasury Management is ready.

We also achieved the highest ever revenue in Foreign Exchange and Merchant Services, underscoring the value of providing comprehensive treasury solutions for our business clients. We’re also proud of successfully implementing our Payment Hub, enabling the Bank to offer faster and more efficient payment options, including Real-Time Payments (RTP), FedNow, and SWIFT. Lastly, we continued investing in Cash Management Online Banking, making the platform more intuitive, user-friendly, and effective for our commercial clients.

Marketing and Community Outreach

Chicago is an expensive and crowded media market. Lakeside Marketing programs break through, as annual research confirms. We’re one of the best-known banks in the city. Our ongoing campaign, with the “It’s about time” theme, supports multiple products and services, and differentiates our client focused culture.

Lakeside retail and commercial events grew in 2024 and we’re dramatically expanding with 30+ programs in 2025. This deepens connections with our consumer and business neighbors. We’re also increasing our hands-on charitable service in 2025. All Lakeside activities are under the “Lakeside Together” umbrella as of early 2025.

There will be challenges in the year ahead. Lakeside will succeed and prosper. We distinguish ourselves with our people and in everything we do. I am so proud of our team and our company. We listen, we’re flexible and proactive. In an age of automation, Lakeside personal service will always win. We will continue to adapt, gather mass, velocity, magnitude, and direction. Lakeside Has Momentum! Sir Isaac would surely be a Lakesider!

Sincerely,

Philip D. Cacciatore

Chairman & Chief Executive Officer

Lakeside Since 1999